Contents:

Investing through an investment app does not require a ton of money to begin. Several spare-change or micro-investing apps allow you to invest with a minimal amount that helps teach financial discipline. For instance, the spare change that remains after rounding up a purchase can be put into your investment app account. It also helps build money awareness, such as cutting down on unnecessary expenses or tweaking your budget to save more and watch your savings and investments grow.

However, the implementation of the Digital India Initiatives, including the Unified Payments Interface , has resulted in a significant transformation of India’s payments landscape. As a result, India now has more real-time online transactions than the United States, United Kingdom, and China combined. The UPI has also allowed India to provide fractional investing capabilities comparable to those found in the United States.

The value of a fractional share is determined by the current market value of the full share, and investors can benefit from any gains or losses in the price of the stock. Micro-investing is saving aside small amounts of money on a regular basis and investing them in the markets through ETFs or fractional stock shares. When you microinvest, you invest a little amount of money on a monthly basis. It makes investing more accessible, particularly since most people do it via an app. If properly invested over time, even small amounts of money may grow into tens of thousands of rupees.

Triton EV Unleashed Manufacturing Plans for India

Among the various customization’s, the one that really draws attention is the retractable Škoda badge on the bonnet. Wealth managers can meet evolving expectations of their clients and capture the growing market of active investors with hyper-personalisation, updated information on taxation and governance, and add newer asset classes. Make the right investment decisions by accessing latest information, news and research reports, worth ₹5,000+ of value when you download the app. Our investment products are designed to help you meet all your investing needs. Passive and Active investing, Large and Small budgets, Individual US Stocks and US Mutual Funds. Moreover, the platform has expanded by including checking account services and retirement IRA products.

- According to various estimates, four out of ten millennials do not invest in the stock market because they feel they do not have enough money to begin.

- Individuals, minors, NRIs , and sole proprietorships are eligible to open Micro SIPs.

- TOKYO, March 1 – Japanese shares rebounded on Monday from the biggest day’s fall in almost a year in the previous session, led by chip and electronics shares, as a pause in the…

- If you’re looking to enter the world of investment without putting in time and effort, using theright investment appcan help you grow wealth and meet your financial goals.

- Withdrawal limits – Micro-investing does not enable you to withdraw your money right away since shares must be sold first.

- Investing.com – Japan equities were higher at the close on Monday, as gains in the Paper & Pulp, Railway & Bus and Real Estate sectors propelled shares higher.

The right way to build long-lasting wealth is to invest continually and let your money grow. Micro-investing lets you tap the power of compounding, and to reap the benefits of compounding returns, you must focus on how long you invest instead of how much you invest. Micro-investing apps are a great way to enter into the world of investing with how much ever money you have as savings. If you contribute consistently, it adds up over time, and by increasing your contribution regularly, you can graduate to bigger investment tools and instruments that can even help you secure your retirement.

Appreciate in the news

Spare8’s mission is to transform the way consumers manage their finances. Our slogan, “Spending is the new investing,” reflects our dedication to assisting Indians in developing better saving habits. With only 3% of the Indian population currently saving or investing, we hope to close the gap and educate people on how to build a financially secure future. Angel One has created short courses to cover theoretical concepts on investing and trading. These are by no means indicative of or attempt to predict price movement in markets. While micro-investing is beneficial to all investors, it is particularly beneficial to young investors, particularly millennials.

So, if you have any spare cash or are able to save a significant sum, you may deposit it into your investing account. You’ll purchase more shares when the prices go down or are low and opposite of it fewer shares when prices are high since you’ll be making regular purchases. You’ll buy over time and average your purchase prices via dollar-cost averaging.

BRIEF-Astra Micro Wave Products to form JV with Unique Broadband Systems

Furthermore, the company’s latest funding round – Series F Round was undertaken on March 9, 2022, in which it raised a total of $300 million. Walter Cruttenden – Co-founder of AcornsWorking as a Founder at Acorns, Walter Wemple Cruttenden III has held the role of CEO at Blast. Presently, he is also working as a President at Cruttenden Partners and Executive Director at Binary Research Institute. Jeff Cruttenden – Co-founder of AcornsJeffrey James Cruttenden is the founder of Acorns and graduated from Lewis & Clark College with a degree in Bachelor of Arts, in Mathematics. In addition to this, he is currently a Partner at Cruttenden Partners and Co-founder at Say.

MicroStrategy buys 1,045 bitcoin, and Invest Diva explains her … – CNBC

MicroStrategy buys 1,045 bitcoin, and Invest Diva explains her ….

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

In 2014, it launched an app for both Android and iOS devices, and portfolio options were designed in partnership with Harry Markowitz – a Nobel-winning advisor. SMEStreet.in is an efficient and dynamic platform for Indian SMEs. ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services.

Latest News

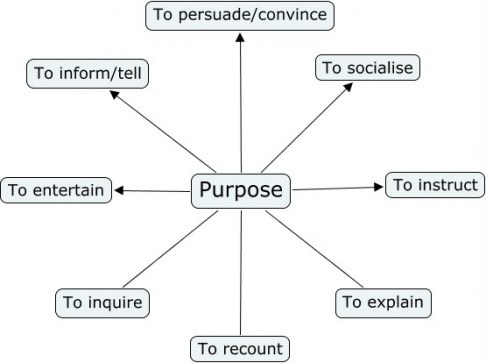

Micro investing entails investing small sums of money in financial instruments such as stocks, digital gold, exchange-traded funds , and mutual funds. It is frequently used to gradually build up a portfolio on a limited budget. If you’re new to investing, a financial app can be the right choice for you. These apps make it effortless for you to invest and allow you to see how to segregate your assets.

Micro investing is an excellent way to begin investing in the stock market on a small budget. It provides several benefits, including the ability to begin investing with a small sum of money and to invest in fractional shares of securities. Choose a platform, sign up for an account, link your bank account, choose your investment strategy, set up automatic deposits, and monitor your investments on a regular basis to get started with micro investing.

Investing.com – Japan equities were higher at the close on Wednesday, as gains in the Insurance, Banking and Gas & Water sectors propelled shares higher. Investing.com – Japan equities were higher at the close on Friday, as gains in the Chemical, Petroleum & Plastic, Textile and Mining sectors propelled shares higher. Investing.com – Japan equities were higher at the close on Monday, as gains in the Chemical, Petroleum & Plastic, Mining and Marine Transport sectors propelled shares higher.

Rs 7/Piece Multibagger Stock Gains 13% in 3 Trading Sessions: In Focus

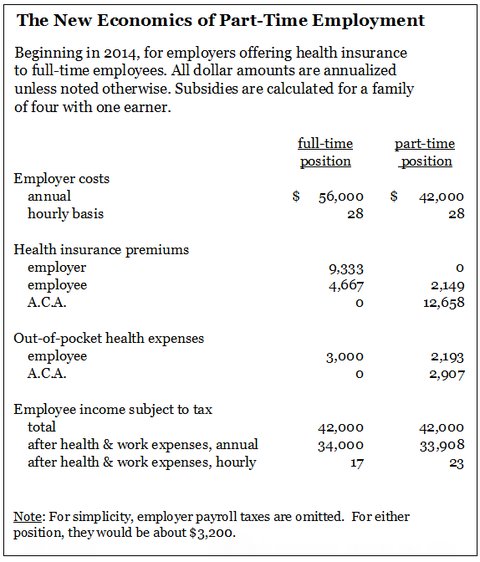

Please read all scheme related documents carefully before investing. Withdrawal limits- Micro-investing doesn’t allow you to withdraw the investment immediately as shares have to be sold. Usually, it can take a few business days up to 4 four or five days to withdraw funds from the account. Flexibility – Although you may start with as little as Rs 50 in micro-investing, most applications enable you to donate as much as you like.

As the famous saying goes, “Many a little makes a mickle” https://1investing.in/-investing makes small amounts add up toward fulfilling short-term investment goals and kicks off your ambitions of long-term wealth creation. If you keep Rs 10 every day in a piggy bank or savings account, you are not earning any returns, or any returns are immediately nullified by rising inflation. And if you keep collecting it to invest in the future, you are missing out on the compounding interest you would’ve earned when it was sitting idle all those years. Deshpande Startups organised Elevate Women Demo Day as a part of the 16-week cohort-based Elevate Women Accelerator Program. Acorns MissionThe company’s main aim is to look after the financial best interests of the up-and-coming, beginning with the empowering, proud step of micro-investing.

In 2018, a behavioral economist- Shlomo Benartzi was appointed Chair of the Behavioral Economics Committee to work on the initiative of Money Lab conducting field experiments to know stats about consumer spending. None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors. The securities quoted are exemplary and are not recommendatory. ICICI Securities is not making the offer, holds no warranty & is not representative of the delivery service, suitability, merchantability, availability or quality of the offer and/or products/services under the offer. The information mentioned herein above is only for consumption by the client and such material should not be redistributed.

If you’re looking to enter the world of provisions without putting in time and effort, using theright investment appcan help you grow wealth and meet your financial goals. A wide array of digital apps such as expense trackers, stock market apps, tax-saving tools, investment, and digital lending apps emerged to help millennials address their financial planning needs. This evolving new trend is revealing young investor appetites to save and invest and discover new investment opportunities. Deciml is a Pune-based fintech firm founded in 2020 by Satyajeet Kunjeer, a CFA Level 2 holder and experienced entrepreneur.

- And while this generation is extremely tech-savvy and aware, when it comes to their finances, they may be high intent but are a little oblivious.

- Additionally, the app’s layout has been redesigned for greater simplicity and clarity in understanding the investing process and tracking of money.

- So, if you have any spare cash or are able to save a significant sum, you may deposit it into your investing account.

- In addition to this, he is currently a Partner at Cruttenden Partners and Co-founder at Say.

- Overall, micro-investing apps have the potential to help individuals save, invest, and secure their financial future.

Astra Micro Wave Products Ltd share price live 308.00, this page displays NS ASTM stock exchange data. View the ASTM premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Astra Micro Wave Products Ltd real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the ASTM quote. Trend Micro Inc. share price live 6,630.0, this page displays TYO 4704 stock exchange data.

Acorns – Products and Services

Other noted names such as Ranveer Allahbadia, Raj Shamani, Suhani Shah, Praful Billore, Varun Thakur, Viraj Sheth, and Rohit Raj, as well as startup advisors like Abhishek Ponia had also participated in the pre-seed round. CXOtoday is a premier resource on the world of IT, relevant to key business decision makers. We also provide business and technology news to those who evaluate, invest, and manage the IT infrastructure of organizations. CXOtoday has a well-networked and strong community that encourages discussions on what’s happening in the world of IT and its impact on businesses. Mutual funds can offer Micro SIPs with a maximum investment amount of INR 50,000, as per the regulations set by the Securities and Exchange Board of India .

Commercial Real Estate: A bankable and reliable investment channel – The Financial Express

Commercial Real Estate: A bankable and reliable investment channel.

Posted: Mon, 01 May 2023 08:25:22 GMT [source]

Deciml is a regulated platform that is accredited by SEBI and AMFI and adheres to their guidelines. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit. The Indian finance minister suggested against using cryptocurrency.The law enforcement organization blocked the assets of two crypto exchanges.At a BJP Economic Cell event on Saturday,… Spare change investment virtualizes and automates the entire process of manually acculturating cash and investing.

Micro SIP aims to help small investors who may not have large sums of money to invest in mutual funds, to start investing with smaller amounts. Micro SIPs can be beneficial for individuals with low incomes, students receiving pocket money, and even children. By saving just Rs 100 to Rs 500 each month, anyone can accumulate a substantial sum of money without straining their finances.